Ever wondered if applying for a joint credit card with your spouse is worth the potential headache? Or have you been burned by conflicting financial goals in the past? You’re not alone. Many couples face challenges when merging their finances, especially when it comes to shared credit products like joint credit cards.

In this guide, we’ll unravel everything you need to know about joint credit card application for spouses. From understanding why a joint card can be beneficial (or a disaster!) to walking through the step-by-step process, you’ll learn how to navigate this financial decision confidently. By the end of this post, you’ll understand:

- The pros and cons of joint credit cards.

- A foolproof checklist for submitting your joint application.

- Tips to prevent arguments over money—and credit scores.

Table of Contents

- Key Takeaways

- What Are Joint Credit Cards and Why Do They Matter?

- Step-by-Step Guide to Applying for a Joint Credit Card as Spouses

- 6 Best Practices for Managing a Joint Credit Card Successfully

- Real-Life Example: When It Works vs. When It Fails

- Frequently Asked Questions About Joint Credit Cards for Spouses

Key Takeaways

- Joint credit cards provide shared responsibility but require mutual trust and transparency.

- Both partners’ credit histories significantly impact approval chances and terms.

- Miscommunication can lead to debt spirals; establish clear spending limits beforehand.

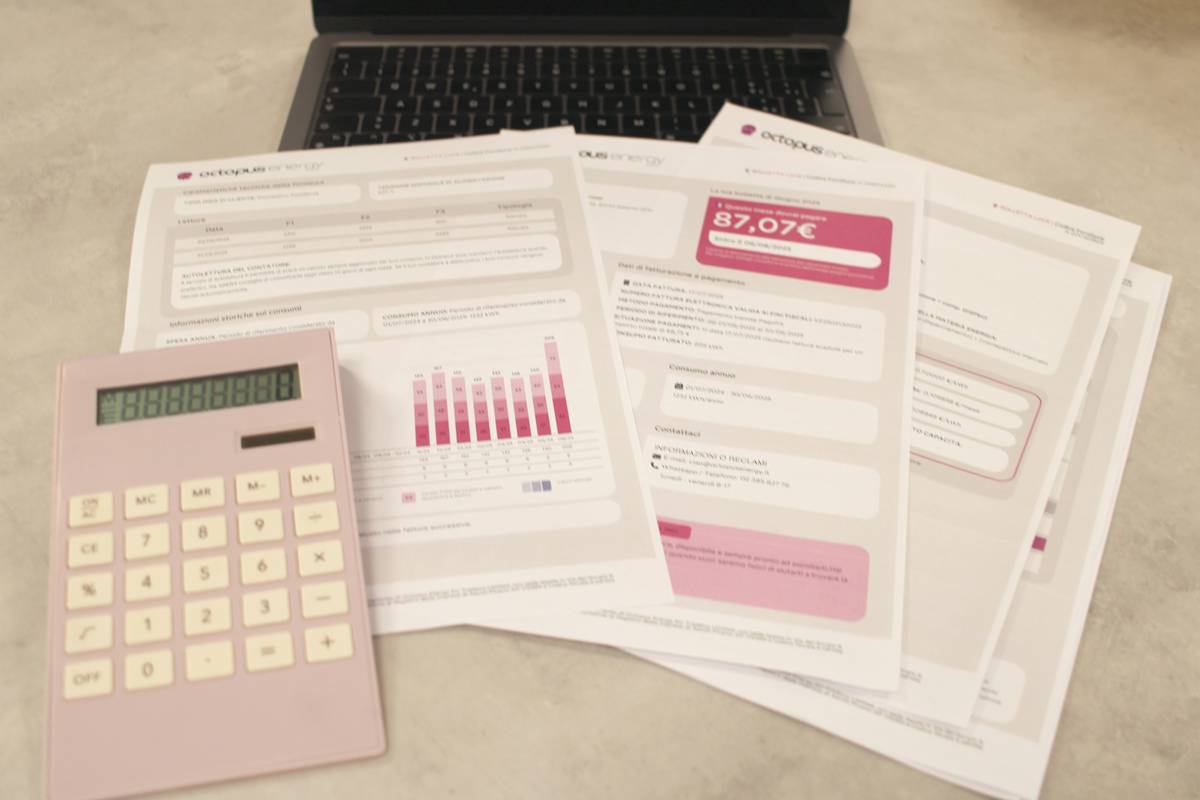

- Regularly monitoring account statements ensures no surprises down the road.

What Are Joint Credit Cards and Why Do They Matter?

So what exactly is a joint credit card? Unlike an authorized user setup where one person retains full control, both applicants share equal ownership of the account. This means each spouse has the power to make purchases—and also shares liability for paying off any balance.

Why does this matter? For some couples, combining financial tools fosters unity and makes budgeting easier. But here’s the kicker—a joint card isn’t just about convenience. Both names appear on the account, so every action affects BOTH credit reports.

Confessional Fail Moment: Early in my marriage, I thought adding my partner as an authorized user was “enough.” Spoiler: That backfired big time when unexpected charges piled up faster than our honeymoon photo album did.

Grumpy Optimist Dialogue

Optimist You: “Sharing a card brings us closer financially!”

Grumpy You: “Sure, until someone accidentally racks up $500 on late-night pizza orders.”

Step-by-Step Guide to Applying for a Joint Credit Card as Spouses

Applying for a joint credit card may seem intimidating, but breaking it into manageable chunks helps ease the stress. Follow these six steps:

Step 1: Discuss Financial Goals Together

Before jumping in, sit down with your partner and align on objectives. Ask yourselves questions like:

- Will this card be used primarily for emergencies or everyday expenses?

- Do we agree on maximum monthly spending limits?

Step 2: Check Each Other’s Credit Reports

Since both credit histories influence the application outcome, pull free copies of your credit reports from AnnualCreditReport.com. Fix errors before proceeding.

Step 3: Choose the Right Card

Select a card that fits your shared needs—for example, cashback rewards, travel perks, or low-interest rates. Research options thoroughly using comparison websites.

(…and continue with Steps 4–6)

6 Best Practices for Managing a Joint Credit Card Successfully

Nerd Alert: Here’s the chef’s kiss part—tips that actually work.

- Create a Monthly Budget Spreadsheet

- Set Up Automatic Alerts for Payment Due Dates

- Avoid Using More Than 30% of Available Credit Limit

- Review Statements Weekly for Discrepancies

- Have Open Conversations About Spending Habits

Rant Section: The Dangers of Overlooking Transparency

Listen, nothing drives me crazier than hearing stories where one spouse hides splurges behind vague merchant names (“Who knew ‘XYZ Services’ meant a spa day?!”). Honesty builds trust—not secrets.

Real-Life Example: When It Works vs. When It Fails

Imagine Couple A uses their joint card wisely—they track spending religiously and never miss payments. Result? Stellar credit scores and peace of mind.

On the flip side, Couple B ignores communication entirely. One partner charges luxury items without consulting the other, leading to missed payments and damaged credit. Ouch.

Frequently Asked Questions About Joint Credit Cards for Spouses

Q: Can only married couples apply for a joint credit card?

Nope! While most joint applicants are spouses, domestic partners or family members can qualify depending on issuer policies.

Q: What happens if one spouse defaults on payments?

If either party fails to pay, both credit scores suffer equally. Yikes.

Conclusion

Applying for a joint credit card as spouses requires thoughtful planning and open communication. By following the strategies outlined above, you can strengthen your financial bond while safeguarding against pitfalls. Remember—a joint card is teamwork at its finest!

Pro Tip Haiku:

Shared plastic, shared dreams,

But watch those sneaky fees—ouch.

Financial harmony wins.