Ever tried applying for a joint credit card only to be buried under mountains of confusing paperwork and jargon? Yeah, we’ve all been there.

In today’s post, we’re diving deep into what makes a joint credit card application tick—literally. We’ll explore joint credit card application requirements, how they work, and the exact steps you need to take to avoid an application nightmare. By the end of this guide, you’ll have clarity on eligibility criteria, required documentation, and insider tips to make your experience smooth as butter (or coffee with cream).

Table of Contents

- Key Takeaways

- Why Joint Credit Cards Matter

- Step-by-Step Guide to Joint Credit Card Applications

- Tips & Best Practices for Successful Applications

- Real-Life Examples of Joint Credit Cards in Action

- FAQs About Joint Credit Card Application Requirements

Key Takeaways

- A joint credit card allows multiple applicants to share responsibility for payments.

- You must meet strict income verification, credit score checks, and identity proofs during the application process.

- Beware of co-signer liability risks if one party defaults.

- Not all banks offer joint accounts; research before applying!

- Using tools like pre-qualification tools saves time and increases approval odds.

Why Joint Credit Cards Matter

I once applied for a shared household expense account without realizing my partner had missed paying off old medical bills. Spoiler alert: The rejection email felt worse than finding out pineapple belongs on pizza. 😤

Whether you’re planning a wedding or just trying to manage family finances better, understanding joint credit card application requirements can save you from unnecessary stress—and debt headaches later. Here’s why:

- Shared Financial Goals: Joint cards are ideal for couples or business partners who want to pool resources while maintaining accountability.

- Simplified Spending: Say goodbye to splitting tabs manually when both names are legit on the card.

- Improved Credit Scores: With responsible usage, both parties benefit from timely payments reflected on their individual credit reports.

Step-by-Step Guide to Joint Credit Card Applications

Let me break it down so even your Grumpy Monday self won’t bail halfway through:

Step 1: Check Your Eligibility Together

*Optimist You:* “We’ve got this!”

*Grumpy Coffee-Fueled You:* “Sure thing…but ONLY after I finish my triple espresso.”*

Before applying:

- Verify each applicant’s credit score—most issuers prefer at least 670+.

- Gather proof of stable income (pay stubs, tax returns).

- Ensure neither party has any major delinquent debts flagged by lenders.

Step 2: Research Issuer Policies

Not every bank offers joint applications because #complicatedbankingrules. Call or visit websites to confirm policies upfront—this is where many folks trip up big time.

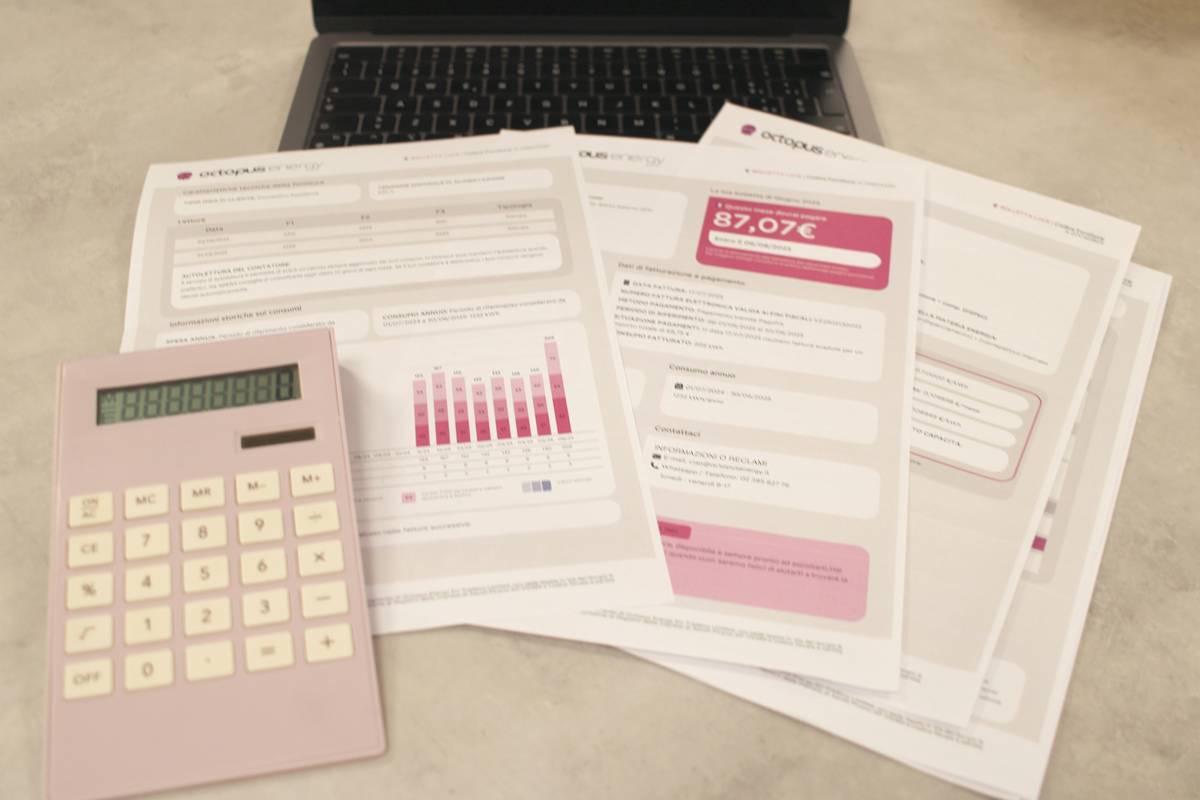

Step 3: Collect Necessary Documents

Think passport photos but for financials:

- ID Proof: Driver’s license/passport.

- Income Verification: Bank statements, W-2 forms.

- Residence Address Details.

Step 4: Submit Application Online

Once armed with docs, apply via the issuer’s website/app. Don’t forget to double-check details—you wouldn’t believe how often typos derail approvals.*facepalm*

Tips & Best Practices for Successful Applications

To maximize success:

- Pre-Qualify First: Use soft-pull inquiries to gauge likelihood without hurting your scores.

- Set Clear Boundaries: Agree beforehand on spending limits per person to avoid surprises.

- Monitor Regularly: Log in monthly to track expenditures together—it builds trust faster than a rom-com montage.

And here’s the brutal truth you don’t wanna hear:

**Do NOT skip reading terms & conditions. Yes, that fine print stuff.** One tiny clause could mean disaster if overlooked.*rant over*

Real-Life Examples of Joint Credit Cards in Action

Case Study: Sarah & Mike

When Sarah moved cities for work, she and her husband Mike opened a joint card exclusively for travel expenses. They managed $5k annually together seamlessly thanks to clear communication and budget tracking apps. Result? Skyrocketing rewards points + zero fights over “who paid last.” 🌟

FAQs About Joint Credit Card Application Requirements

Q1: Can anyone apply for a joint credit card?

Nope! Most issuers require both parties to demonstrate solid credit history and sufficient income stability.

Q2: What happens if we miss a payment?

Both parties’ credit scores will tank faster than a dropped ice cream cone in summer heat.*ouch*

Q3: Are there alternatives to joint accounts?

Absolutely! Authorized user status might be simpler depending on needs—but remember liabilities differ significantly.

Conclusion

Applying for a joint credit card doesn’t have to feel harder than solving a Rubik’s Cube blindfolded. With these insights into joint credit card application requirements, you’re now ready to rock your shared financial journey.

Recap:

-Key steps include verifying eligibility, gathering documents, and submitting carefully reviewed applications.

-Best practices involve monitoring activity regularly and setting boundaries early.

-Always read those pesky T&Cs thoroughly—they exist for reasons beyond annoying us!

P.S. A little something extra since you made it this far:

Like handling cryptic SEO rules, mastering joint credit cards takes patience but pays dividends (*chef’s kiss*). Oh, and don’t forget—just like Tamagotchis needed daily care back in the day, healthy credit habits demand regular attention too!